PH Onett Computation Sheet Annex B-4 free printable template

Show details

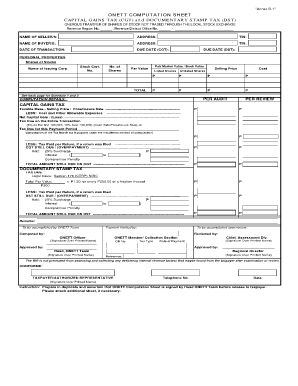

CONFORME TAXPAYER/AUTHORIZED REPRESENTATIVE Telephone No. Date Instruction Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer. Annex B-4 ONETT COMPUTATION SHEET EXPANDED WITHHOLDING TAX EWT and DOCUMENTARY STAMP TAX DST SALE OF REAL PROPERTY CONSIDERED AS ORDINARY ASSET Revenue Region No. Revenue District Office No. - NAME OF SELLER/S ADDRESS TIN NAME OF BUYER/S DATE OF TRANSACTION DUE DATE EWT OCT/TCT CCT No. Tax...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign onett computation sheet form

Edit your onett computation sheet donor's tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your onett computation sheet ewt dst form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit onett computation sheet withholding tax online online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit purchase form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out seller buyer form

How to fill out PH Onett Computation Sheet Annex B-4

01

Begin by gathering all necessary financial documents and information required for the computation.

02

Open the PH Onett Computation Sheet Annex B-4 template.

03

Fill in the basic information such as the name, date, and purpose of the computation at the top of the sheet.

04

Transition to inputting the income details in the designated section, ensuring to include all sources of income accurately.

05

Move to the expenses section and list all relevant expenses, clearly categorizing them as needed.

06

Calculate the total income and total expenses by summing the respective columns.

07

Deduct the total expenses from the total income to determine the net income.

08

Review all entries for accuracy and completeness before finalizing the sheet.

09

Save or print the completed sheet for submission or record-keeping.

Who needs PH Onett Computation Sheet Annex B-4?

01

Individuals or businesses preparing financial reports.

02

Accountants and financial advisors working on behalf of clients.

03

Organizations required to submit financial computations for tax or regulatory compliance.

04

Any entity needing to assess their financial position through structured documentation.

Fill

bir onett computation sheet

: Try Risk Free

People Also Ask about seller buyer tax

How much is CGT and DST in Philippines?

CAPITAL GAINS TAX (CGT): 6% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher. DOCUMENTARY STAMP TAX (DST): 1.5% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher.

Where do I pay capital gains tax on real estate?

1706) shall be filed and paid within thirty (30) days following the sale, exchange or disposition of real property, with any Authorized Agent Bank (AAB) or Revenue Collection Officer (RCO) of the Revenue District Office (RDO) having jurisdiction over the place where the property being transferred is located.

What Onett means?

The following One-Time Transaction (ONETT) taxpayers who are not eFPS registered are required to use eBIR Forms: a. Taxpayers who are classified as real estate dealers/developers; b. Taxpayers who are considered as habitually engaged in the sale of real property; and.

How much is the capital gains tax in the Philippines 2022?

For real property - 6%. Mandatory Requirements: TIN of Seller/s and Buyer/s; One (1) original copy for presentation only) Notarized Deed of Absolute Sale/Document of Transfer but only photocopied documents shall be retained by BIR; (One (1) original copy and two (2) photocopies)

How do I pay my CGT and DST Philippines?

5 steps on processing the CGT and DST in BIR STEP 1 SUBMIT: Submit the following documents at the Bureau of Internal Revenue Regional District Office (BIR RDO) that handles the property's location: STEP 2 CALCULATE: STEP 3 FILL OUT: STEP 4 PAYMENT: STEP 5 CLAIM:

How to compute capital gains tax and documentary stamp tax?

CAPITAL GAINS TAX (CGT): 6% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher. DOCUMENTARY STAMP TAX (DST): 1.5% of the selling price (SP) or the zonal value or the Fair Market Value of the property, whichever is higher.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in onett computation without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit onett bir and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the computation sheet in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your onett computation sheet excel download and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out bir routing slip form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your onett computation sheet bir. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is PH Onett Computation Sheet Annex B-4?

PH Onett Computation Sheet Annex B-4 is a specific form used for the calculation and reporting of certain tax-related information in the Philippines.

Who is required to file PH Onett Computation Sheet Annex B-4?

Entities and individuals that are subject to the relevant tax regulations in the Philippines are required to file the PH Onett Computation Sheet Annex B-4, particularly those involved in specific business activities as defined by the Bureau of Internal Revenue (BIR).

How to fill out PH Onett Computation Sheet Annex B-4?

To fill out PH Onett Computation Sheet Annex B-4, one must enter relevant financial data, including income, deductions, and other taxable amounts, in the specified fields, and ensure that all calculations adhere to the guidelines set by the BIR.

What is the purpose of PH Onett Computation Sheet Annex B-4?

The purpose of PH Onett Computation Sheet Annex B-4 is to provide a structured format for taxpayers to report their tax computations accurately, ensuring compliance with tax laws and facilitating the assessment of tax liabilities.

What information must be reported on PH Onett Computation Sheet Annex B-4?

The information that must be reported on PH Onett Computation Sheet Annex B-4 includes gross income, allowable deductions, taxable income, and applicable tax rates, along with any other relevant financial details specific to the taxpayer's situation.

Fill out your PH Onett Computation Sheet Annex B-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Seller Form is not the form you're looking for?Search for another form here.

Keywords relevant to onett bir meaning

Related to onett computation sheet tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.