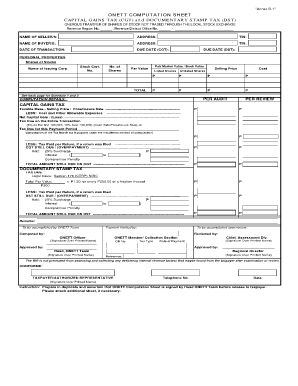

PH Onett Computation Sheet Annex B-4 free printable template

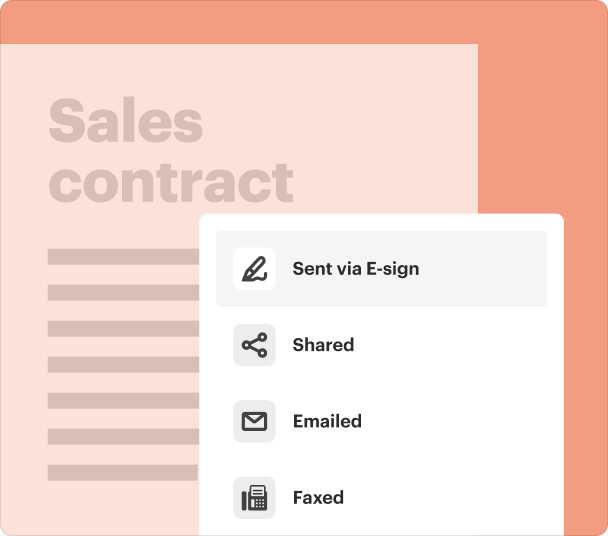

Fill out, sign, and share forms from a single PDF platform

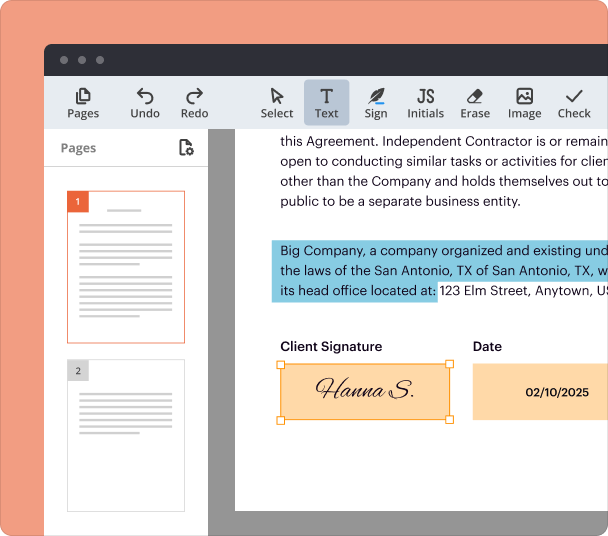

Edit and sign in one place

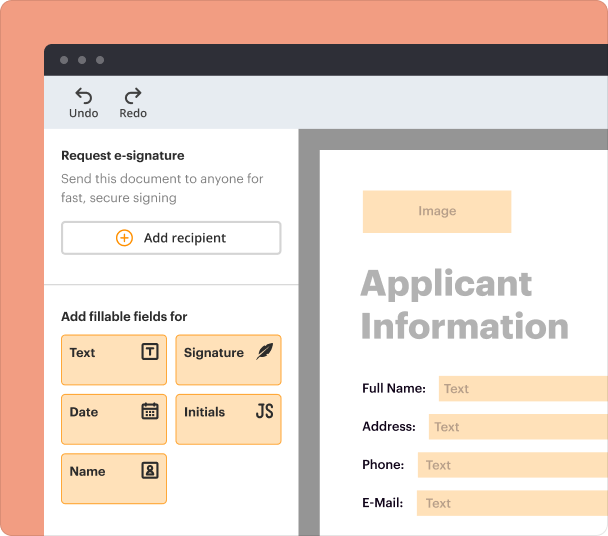

Create professional forms

Simplify data collection

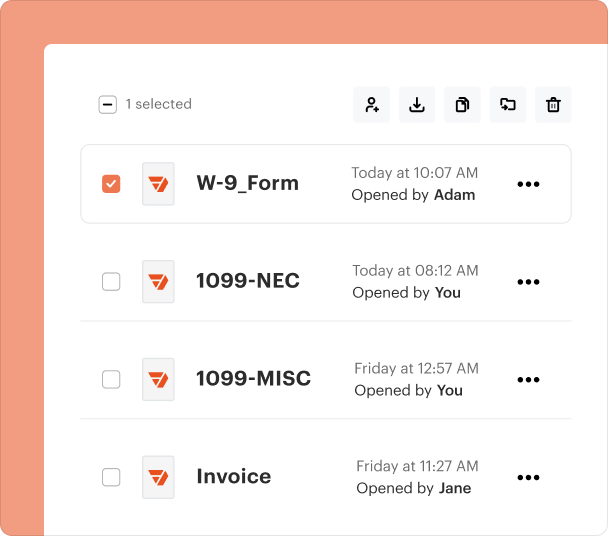

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive guide to the ONETT computation sheet on pdfFiller

TL;DR – How to fill out a ONETT computation sheet form

To fill out a ONETT computation sheet form, begin by entering the seller and buyer information accurately. Next, include transaction and property details, ensuring correct tax calculations for Expanded Withholding Tax (EWT) and Documentary Stamp Tax (DST). Finally, verify the form and manage payment details before submission.

What is the ONETT computation sheet?

The ONETT computation sheet is an essential document used in real property transactions to calculate tax obligations. It primarily covers the Expanded Withholding Tax (EWT) and the Documentary Stamp Tax (DST), making it vital for individuals and teams involved in real estate.

-

The ONETT computation sheet helps ensure compliance with tax regulations during property sales.

-

Includes calculations for EWT and DST based on property sale prices and fair market values.

-

Real estate professionals and individual sellers or buyers who need to report their transactions accurately.

How do you fill out the ONETT computation sheet step-by-step?

Filling out the ONETT computation sheet is a streamlined process that begins with collecting all necessary data. Each section needs to be filled in carefully to ensure the accuracy of tax calculations.

-

Input the full names, addresses, and Tax Identification Numbers (TIN) of both parties.

-

Record the transaction date and due date clearly in the specified fields.

-

Enter comprehensive details regarding the location, classification, area, and zonal value of the property in question.

What are the tax calculations for the ONETT computation sheet?

Calculating taxes on the ONETT computation sheet involves determining the appropriate amounts for both EWT and DST based on the provided data. Accurate tax assessments are critical to avoid penalties.

-

Calculate EWT by applying the defined tax rates to the tax base from the transaction.

-

Determine DST using the Fair Market Value and Selling Price to find the correct figure.

-

Understanding the legal bases for tax calculations is essential for compliance with regulations.

How do you manage payments and overpayments on the ONETT sheet?

Managing payments and overpayments accurately is crucial when dealing with the ONETT computation sheet. Proper input and record-keeping can prevent future disputes.

-

Carefully enter any expected payments and detail how to handle potential overpayments.

-

Educate yourself on applicable surcharges, interests, and penalties for either late or incorrect tax payments.

-

Implement strategies for managing tax return filings related specifically to EWT and DST.

Why is the verification and review process important?

The verification and review process serves as a crucial step in ensuring that all computations are accurate. It helps prevent mistakes that could lead to legal repercussions.

-

The ONETT Team plays a vital role in reviewing and verifying computations for accuracy.

-

Utilize a checklist to validate every entry before the final submission of the form.

-

Gather important signatures from relevant parties, including an ONETT Officer and the Chief Assessment Division.

What are common challenges and solutions in completing the ONETT computation sheet?

Common challenges faced while completing the form often stem from miscalculations or misunderstanding of processes. However, these obstacles can be addressed through best practices.

-

Identify common problems such as common miscalculations and understand their solutions.

-

Adopt best practices to ensure accuracy and compliance during the form completion.

-

Leverage tools and features on pdfFiller to streamline the process, such as eSigning and document editing.

What regulatory references and compliance notes should you consider?

Understanding the regulatory landscape is essential for those filling out the ONETT computation sheet. Proper compliance ensures that all standards are met.

-

Be aware of regulations such as RR No, CTRP, and NIRC that impact your computation sheet.

-

Ensure compliance with local laws in the Philippines when completing forms and submissions.

-

Understand the potential consequences of failing to adhere to regulations.

Which pdfFiller features facilitate document management?

pdfFiller offers a robust suite of features designed to simplify document management, particularly for tax-related forms like the ONETT computation sheet.

-

The platform provides tools to edit, eSign, and collaborate on various documents.

-

Benefits of using pdfFiller include the convenience of managing tax documents from anywhere.

-

Designed specifically for ensuring compliance with tax forms, pdfFiller makes managing the ONETT computation quick and efficient.

Frequently Asked Questions about onett computation sheet form

What is the ONETT computation sheet used for?

The ONETT computation sheet is used for calculating taxes involved in real property sales, specifically the Expanded Withholding Tax (EWT) and the Documentary Stamp Tax (DST). It serves to ensure compliance with tax obligations during property transactions.

How can pdfFiller help with filling out the ONETT form?

pdfFiller offers easy-to-use tools for editing, eSigning, and managing documents like the ONETT computation sheet. Its cloud-based features provide accessibility from anywhere, making the process efficient.

What are the penalties for incorrect submissions?

Submitting incorrect information on the ONETT computation sheet can result in penalties, including fines or legal issues related to tax compliance. Hence, it’s crucial to double-check all entries.

Can I save my progress on the ONETT computation sheet in pdfFiller?

Yes, pdfFiller allows you to save your progress on your documents, making it easy to return and complete the ONETT computation sheet at your convenience.

What happens if I fail to comply with local regulations?

Non-compliance with local regulations can lead to legal repercussions, including fines or other penalties. Adhering to guidelines is vital for smooth real estate transactions.

pdfFiller scores top ratings on review platforms